Our Complimentary Reports

Enter your email to get free reports

Press "Get Free Report" Button to Download the Reports

In order to serve our clients best, be a value-added resource, and provide custom retirement solutions, we need to have a comprehensive evaluation of each client's specific needs. Thus, we provide 10 complimentary reports to clients.

-

My Retirement Coach's promise to you: we will help you with your retirement and financial planning and provide you a written financial plan.

-

No obligation and No commitment to have to work with us.

-

We work as a team and work together to develop a custom strategy for you.

-

In order for us to help you, you have to help us and do your "homework." You have to get your information to us so that we can have accurate reports.

Enter Your Email to Download the Report

The 1st step in the process of you getting our complementary reports is having accurate and realistic data input: your budget. In My Retirement Coach's Retirement & Financial Planning process, we work as a team with you to create custom reports. Thus, our starting point is your monthly revenues and expenses. Initially, we'll need to get the big picture, larger categories of your budget so we can begin the process of helping, or "coaching" you withe your financial planning.

Enter Your Email to Download the Report

FREE Report #1

Retirement Income Report

SIPS or Retirement Income Report

-

This simple 1-page report shows your income, expenses, and cash flow (your "green bucket" cushion) each year in retirement.

-

It has your assets which provide income (investment portfolios) or can be convertible to income.

-

This is a dynamic report which we update every quarter, or as often as clients have a life change.

Enter Your Email to Download the Report

FREE Report #2

SS Maximization Report

Social Security Maximization Report

-

There are 81 ways to file Social Security Benefits, and 90% of filers do NOT maximize their benefits.

-

Our SS Maximization report provides you with the top 3-5 filing options to get you the most in lifetime benefits.

-

A recent study found that over $111,000 in benefits are "left on the table" by filers; this report ensures that you do not leave money.

Enter Your Email to Download the Report

FREE Report #3

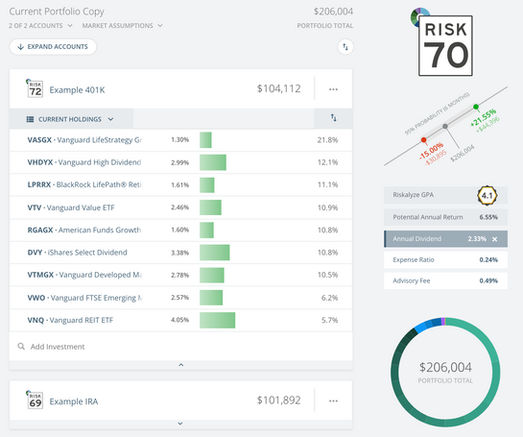

Portfolio Risk Score

Managing your risks in retirement and your risk in your investment portfolios is critical in having a stress free life.

-

Do your know what your personal Risk Tolerance Score ("RTS") is?

-

Do you know what your investment portfolio Risk Score ("RS") is, and how much will you lose in a market correction?

Enter Your Email to Download the Report

FREE Report #4

Long-Term Care Evaluation Report

Long-term Care Evaluation Report

-

What are the considerations for deciding if you or your spouse need long-term care ("LTC")?

-

We will provide an evalution report for you of the potential costs of LTC in California.

-

We will use your custom report to provide suggestions on how to pay for it, either self-insure or look at LTC insurance or hybrid insurance solutions to pay for your LTC need.

Enter Your Email to Download the Report

FREE Report #5

MRC Financial Plan

Financial Plan

-

At My Retirement Coach, we believe each client should have a comprehensive and detailed, written financial plan.

-

Simply put, it is your retirement roadmap that brings together all of your financial and investment needs.

Enter Your Email to Download the Report

FREE Report #6

LifeHub Asset Report

Your LifeHub report, or a 1-page visual summary of all your assets, liability, and equity in retirement.

-

We put this together for clients, and give them access to their report so they can see how their personal balance sheet changes each year (by moving the slider).

-

The visual is a very simple, but provides a complete representation of their financial picture, in a dynamic report.

Enter Your Email to Download the Report

FREE Report #7

Tax Minimization Report

Tax Summary Report

-

This report summaries your tax obligation every year in your retirement. The plan it to minimize your tax liability every year and in your lifetime.

-

We model out and create tax planning strategies to be more efficient with your assets.

-

We look at Roth Conversions, Premium-Financed Life Insurance, and Tax-Harvesting and Direct Indexing of your investment/stock portfolios.

Enter Your Email to Download the Report

FREE Report #8

Legacy Planning Report

Your Legacy Report

-

For your loved ones and family, this Legacy Report provides a 1-page report showing all of your net asset values, and what you will give to your beneficiaries.

-

This is the "leftover" amount of your retirement plan, after the surviving spouse passes.

-

It is a dynamic report, and it shows how much you will leave in earch year.

Enter Your Email to Download the Report

My Retirement Coach FREE REPORTS because we believe that is the starting point for any retirement or financial planning. Knowing what you have now or a starting point of your financials is the most effecient way to come up with solutions to your respective needs.

-

Your Budget is the "starting line." In MRC's financial planning process, we start with your budget - so that is the first and most important report that we do. Of course, if you have an accurate budget that would be great.

-

Your Goals & Objectives - what is our target in the future? It may seem obvious but many of the folks who come in to meet with us have a general idea of what they would like to do in retirement; we just ask more questions to get them to think through all possibilties.

-

Your Customized Reports - after steps 1 and 2, then we get started on completing the necessary reports (listed above) so that we can start to evaluate your financial situation, and come up with solutions or choices for you.

-

Simply put, in this step we create your financial roadmap - we have your starting point and your end point or target, we fill in the "map or plan" in the middle.

-

Finally, we discuss our recommendations for you, with you and fine-tune your solutions.